Renters Insurance in and around Bryan

Renters of Bryan, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

There’s No Place Like Home

It may feel like a lot to think through keeping up with friends, work, your busy schedule, as well as coverage options and savings options for renters insurance. State Farm offers straightforward assistance and unbelievable coverage for your sound equipment, clothing and furniture in your rented property. When trouble knocks on your door, State Farm can help.

Renters of Bryan, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

Renters Insurance You Can Count On

You may be questioning if you really need Renters insurance, but what many renters don't know is that your landlord's insurance generally only covers the structure of the space. How much it would cost to replace your possessions can be substantial. With State Farm's Renters insurance, you have a good neighbor who can help when windstorms or tornadoes occur.

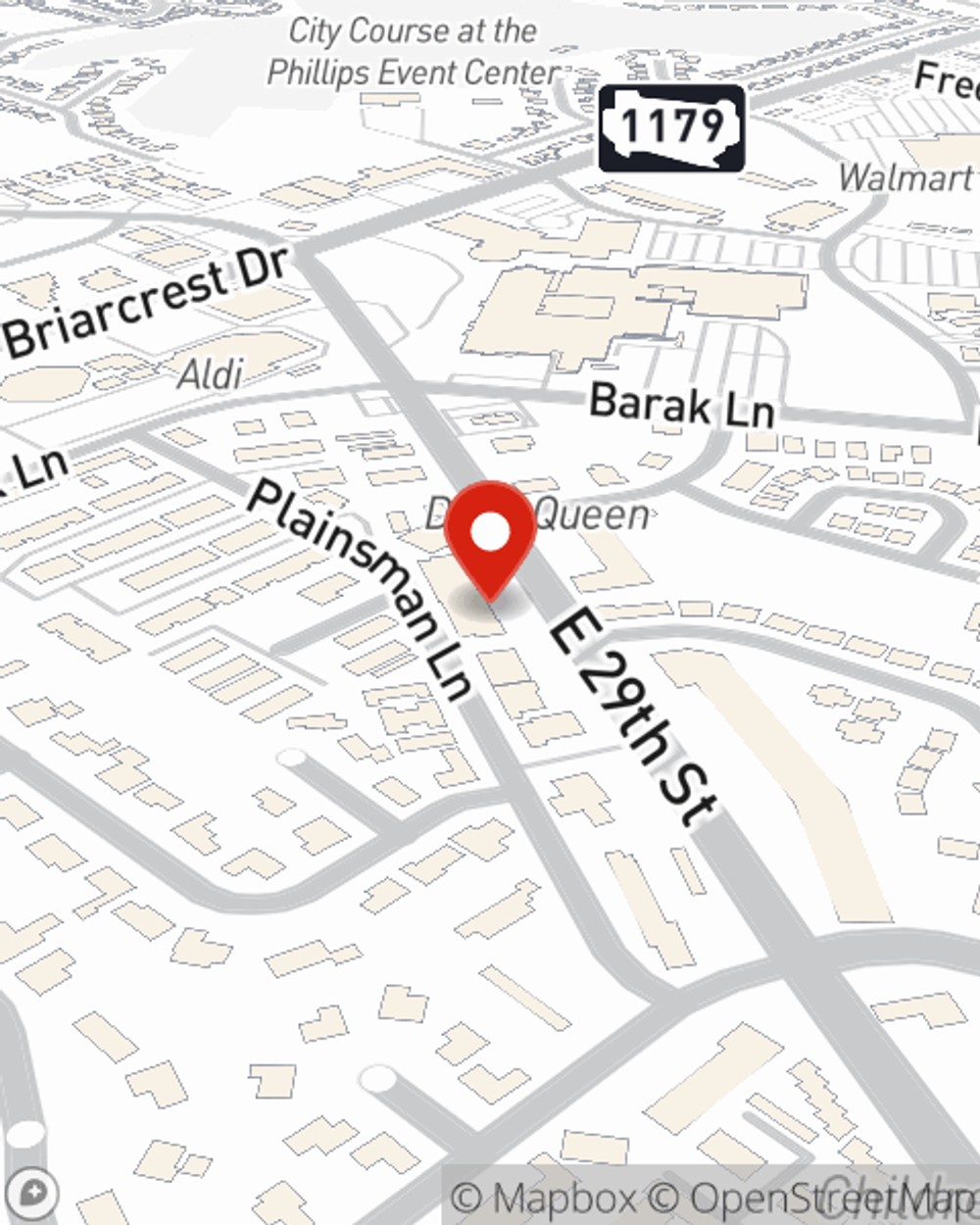

State Farm is a value-driven provider of renters insurance in your neighborhood, Bryan. Reach out to agent Lance Snider today for help with all your renters insurance needs!

Have More Questions About Renters Insurance?

Call Lance at (979) 703-1011 or visit our FAQ page.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Lance Snider

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.